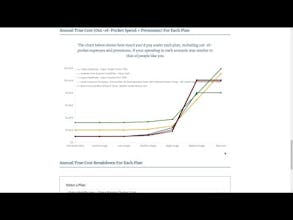

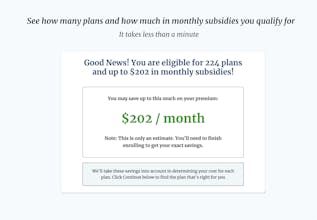

Lumos is a free-to-use tool designed to help you find the ACA health insurance plan that's right for you. Our product finds plans, personalized to you, with the lowest "true-cost" in a matter of minutes. Shop smarter with Lumos and save hundreds of dollars each year.

Subscribe

Sign in

Lumos Health

Flex-Worthy Templates

Lumos Health