Digs.co

Save for a home automatically by earning cash back on rent

1 follower

Save for a home automatically by earning cash back on rent

1 follower

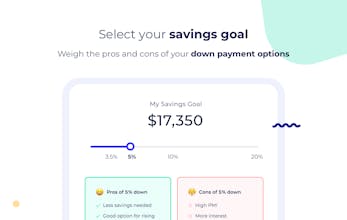

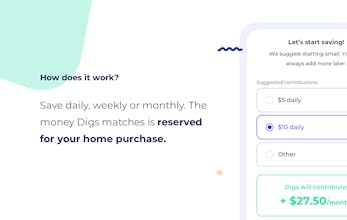

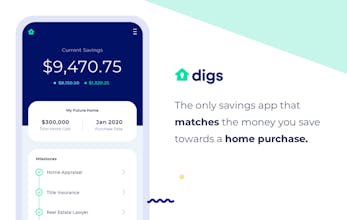

Digs allows you to earn move-in bonuses and cash back on your apartment in order to save for your first home. Simply rent as you normally would and watch your account balance grow. All Digs accounts earn interest and you have the ability to earn more money when you move or through other promotions. Eventually use your savings for a down payment.

This is the 2nd launch from Digs.co. View more

Digs

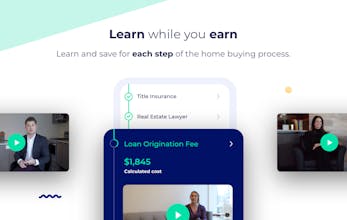

Digs is the only savings app that helps people reach homeownership. It offers a unique contribution matching program that accelerates the saving process. It also helps people make better financial decisions through educational tools and loan recommendations. All Digs accounts are insured by the FDIC up to $250,000.

Launch Team

Digs.co

Digs.co

Horizon

Digs.co

The Almanack Of Naval Ravikant

Digs.co

Digs.co

Digs.co

Digs.co