Mayfair

The 5.02% APY business cash account

4.9•64 reviews•1.1K followers

The 5.02% APY business cash account

4.9•64 reviews•1.1K followers

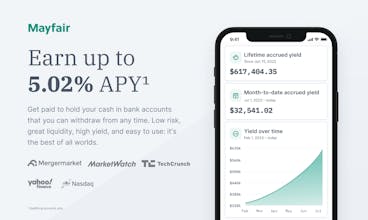

Mayfair is the high-yield cash account that earns you 5.02% APY on your business's cash while protecting it with up to $50m in enhanced FDIC insurance . It takes less than 10 minutes to set up, integrates with your existing bank, and has unlimited free transfers.

This is the 2nd launch from Mayfair. View more

Mayfair

Do you love your business account? Mayfair users say that we're “night and day better than everything else."

With Mayfair, you can earn 5.02% APY and protect it with up to $50m of FDIC insurance. High-yield, low-risk, fully liquid, simple.

Free

Launch Team

Mayfair

Product Hunt

Mayfair

Product Hunt

Chtrbx

Mayfair

Chtrbx

Mayfair

Chtrbx

Mayfair